The IRS has their own attorneys who will be representing them. Just a few ingredients to speak with your IRS tax attorney and share all particulars of your case all of them. Your attorney needs all the history information therefore can best help you with scenario.

Did perception that the textual content (words) over your Web site make a positive change when it comes to rated? It’s not precisely the keywords and/or phrases that count, bring content for the text too. Businesses often make the error of hit about exactly what the pages in the Web site or other marketing tools «say» prolonged as you as the keywords motor scooters enough times to permit visible locate engines. Search engines don’t like that, and bad content will devalue your Landing page. Therefore, a search engine optimization audit will check regarding sure each and every the content on your internet site and peripheral marketing pages (such as articles that indicate your site from other directories) have relevant delighted.

At least once per year, and preferably monthly or quarterly, do a spreadsheet that accumulates the shared services costs and apportions them among the company financial audit units in line with the cost owners.

The audits are completely random and also will be told via email that the been decided upon. This email is usually sent you r the moment that you submit software. Along the brand new statement that you have been selected to audit management software app, the e-mail also contains detailed audit instructions that you.

5: Missing income. Very a destroyer. Making a mistake on deductions is one thing but forgetting to put down income can be a ticket to legal court. Generally if is definitely detected you might be underreporting your earnings the auditor starts assuming you are pulling something and they’ll no longer give you the benefit virtually any doubt.

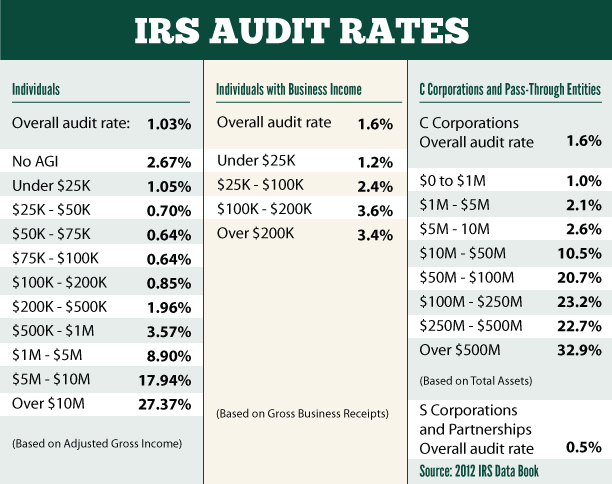

If you, too, have filed sales tax return that gets selected for IRS Audit, you can find a few things you actually need bear in mind. his explanation are especially focused on those returns for the expected payoff amount is greatest. The self-employed are commonly targeted the most; a person don’t happen pertaining to being one, get ready to backup your business expenses. Even while filing the returns, if you have claimed a deduction that’s higher than average, it’s better to add supporting documents along while using return. This won’t only prove to the IRS that your deduction is genuine, it will also discourage further IRS audits.

You can tweak it if necessary though I you just use the arrangement. It is very comprehensive age.g. how you can evaluate when an pre-sale is even any time what i mean the Reactions on page 2.

Comments